Market Morsel

The female slaughter ratio (FSR), which is a measure of the percentage of female cattle processed versus total cattle slaughter, is a useful indicator to determine where the Australian herd sits in terms of rebuild or liquidation phase.

The June 2024 quarter indicator demonstrated a move into liquidation territory for the national herd for the first time since the fallout of the 2019 drought with the FSR lifting from 47% in quarter one to 53.1% in quarter two. The 2021 to 2023 herd rebuild period was characterised by a FSR below the 47% thresh hold which determines which phase of the cattle cycle is underway. On an annual basis the FSR sits at 50.8% presently so well entrenched in a liquidation phase an in line with the Meat & Livestock Australia (MLA) cattle industry outlook that predicts a reduction to the herd into 2025 and 2026.

You can read a little more about the June quarter FSR here.

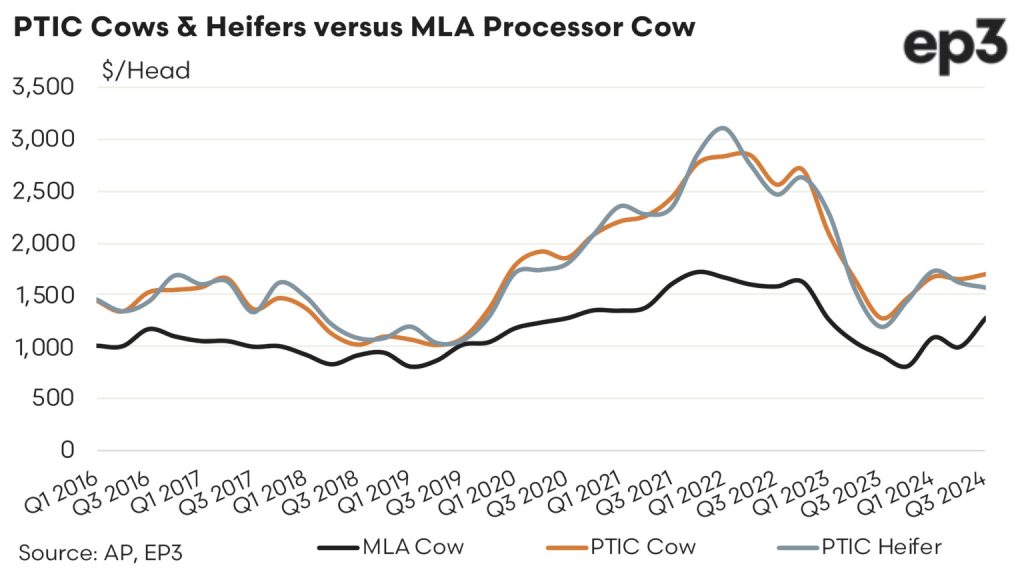

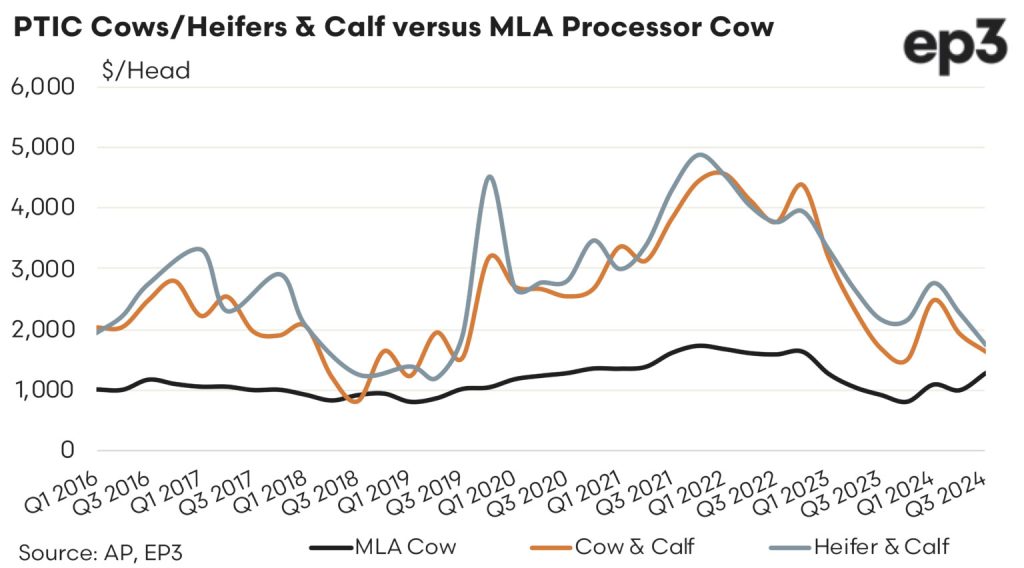

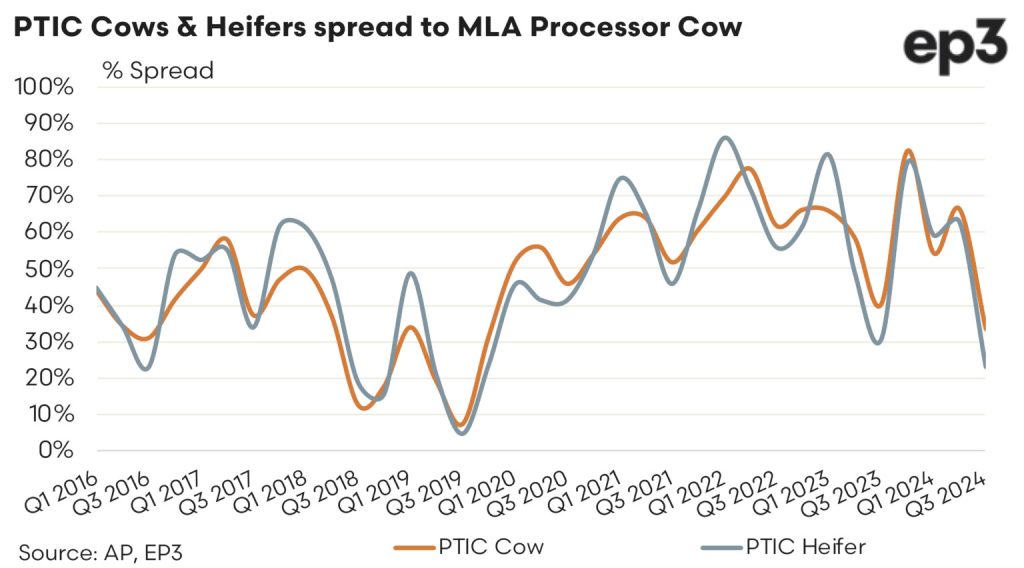

Another measure of herd rebuild or liquidation sentiment is the price spread behaviour of pregnancy tested in calf (PTIC) heifers and cows versus the MLA cow processor indicator, which represents prices of breeding stock not intended to be utilised for herd rebuild purposes. Pricing trends for PTIC types, including those already with calves at foot, shows that the premiums for breeding stock has been narrowing over the last few quarters.

While both PTIC cows, PTIC heifers and the MLA processor cow indicators have all seen price gains since the start of 2024 the price lifts in PTIC categories have not been as robust as the MLA cow benchmark.

A comparison of closing price levels for 2023 versus the Q3 2024 prices highlights that the MLA processor cow has lifted around 58% over the last year, increasing from a quarterly average price of $809/head in the final quarter of 2023 to $1,277/head as at Q3 2023. Meanwhile over the same time frame the AuctionsPlus PTIC cow indicator has gained just 16%, from $1,474 to 1,703/head, and the PTIC heifer has lifted just 9%, from $1,449 to $1,575/head.

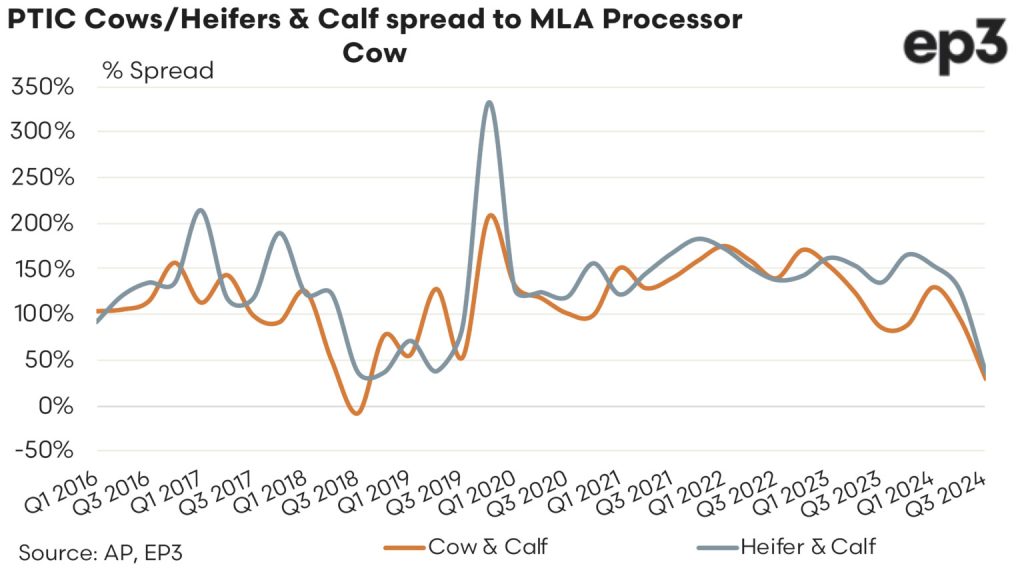

PTIC cow with calf pricing has been reasonably subdued, when comparing Q4 2023 to Q3 2024. Despite a little blip higher in the first quarter of this year current pricing has finished just 8% above the levels seen late last year for PTIC cows with calf moving from $1,523 last year to $1,652/head as at quarter three 2024. Meanwhile a much weaker pattern has been displayed by heifers with calf with this indicator showing a 19% decline from Q4 2023 to Q3 2024, a price drop of $414 from $2,146 to $1,735/head.

The change in producer sentiment towards breeding stock is highlighted when analysis of percentage price spreads is outlined for PTIC types versus the MLA processor cow indicator. As the charts below identify price spreads for PTIC cows and heifers have narrowed from 80% premiums in Q4 2023 to 25-35% premiums as at Q3 2024. Similarly PTIC cow with calf spreads have dropped from 90% to 30% and PTIC heifer with calf spreads have fallen from 150% to 35% over the same time frame. Indeed, price premiums for all PTIC categories are currently at, or rapidly nearing, the rather narrow spread levels seen during the 2019 drought and cattle liquidation phase.

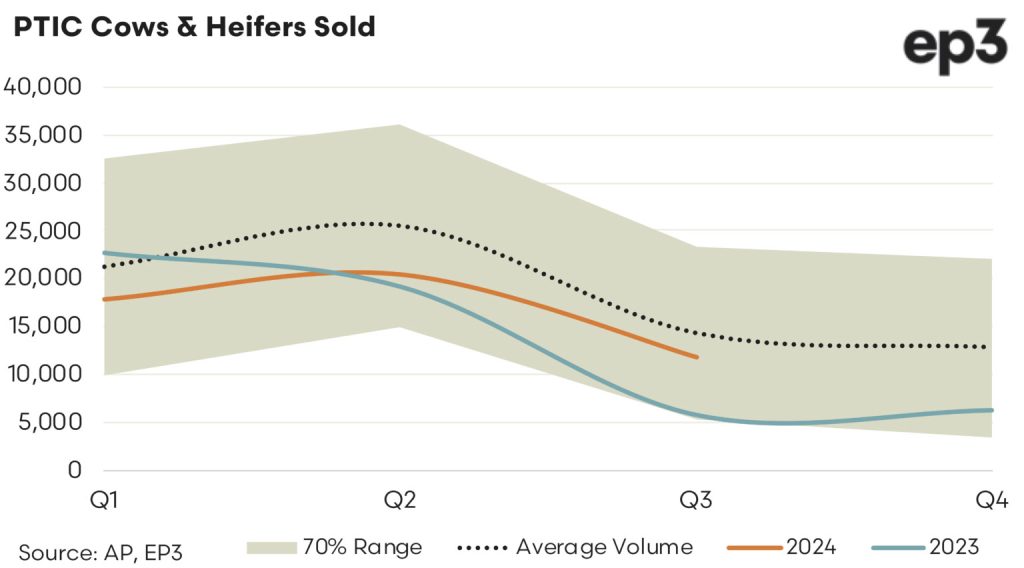

Further contributing to the narrower PTIC premium spreads during Q3 2024, besides the current producer sentiment favouring herd liquidation, are the elevated PTIC numbers sold on the AuctionsPlus platform versus the 2023 season.

As the seasonal sales volume chart demonstrates below while current PTIC volumes remain below the average quarterly volumes seen since 2016 the sales levels seen during the third quarter of this year are about double the volumes seen during Q3 of 2023, when the herd rebuild was in full swing and breeding stock was more difficult to find.