Producer Share December 2024 Quarterly Update

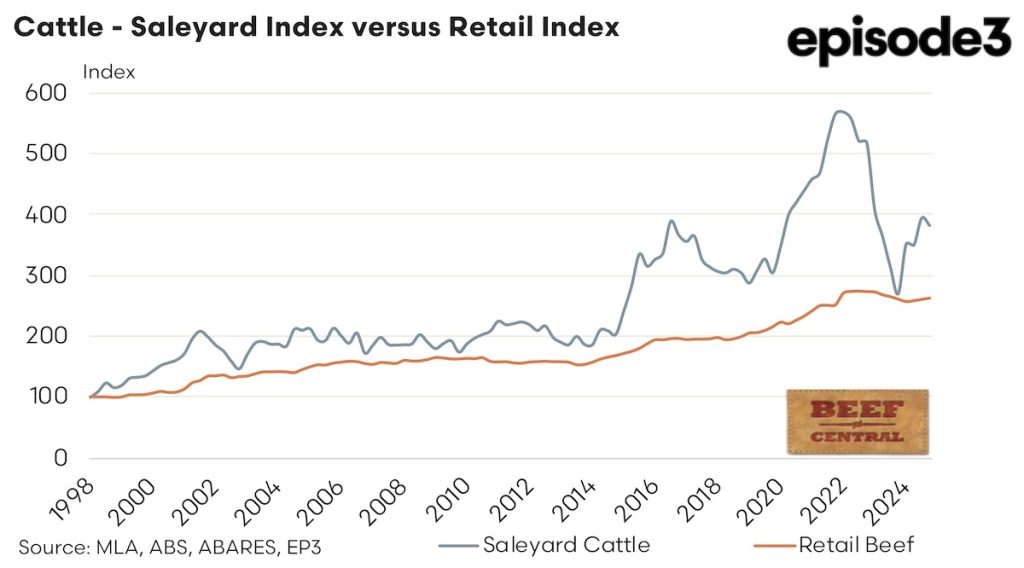

During the fourth quarter of 2024, Australia’s livestock markets experienced mixed trends in saleyard and retail prices, impacting producer share values. Cattle prices at the saleyard level declined from 690c/kg cwt in Q3 to 669c/kg cwt in Q4 on a carcass weigh basis, while retail beef prices increased from 25.75 $/kg rwt to 25.96 $/kg rwt over the same period. This divergence led to a drop in the producer’s share of retail value, falling from 39.0% to 37.5%, reflecting weaker saleyard conditions despite retail price increases.

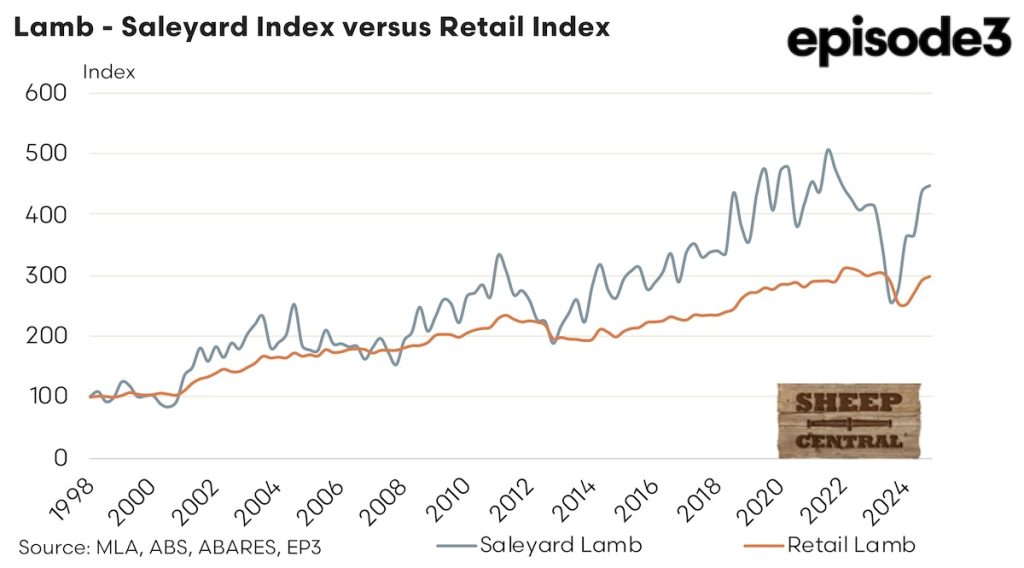

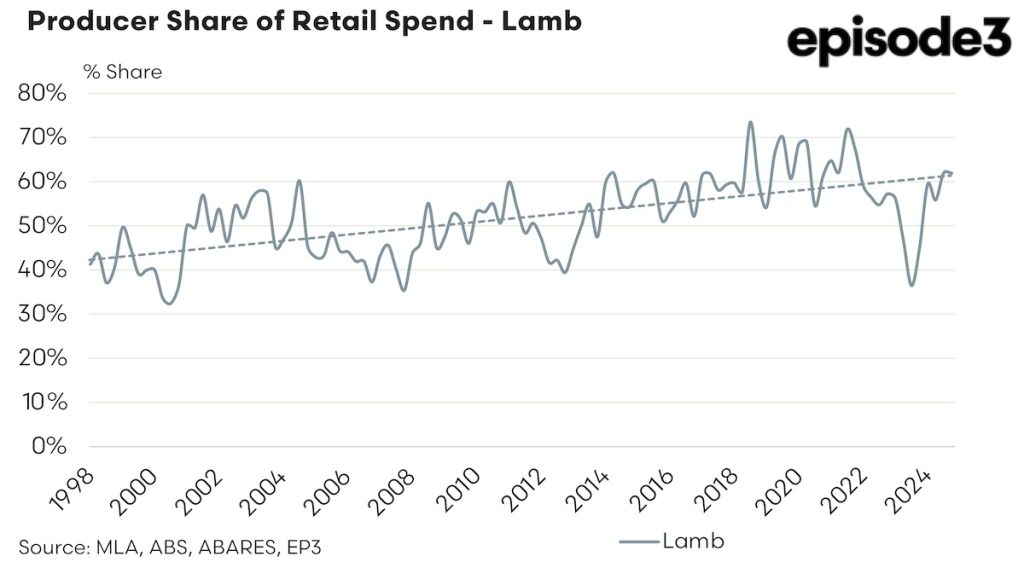

Conversely, lamb prices strengthened at both the saleyard and retail levels. The saleyard price for lamb increased from 807c/kg cwt in Q3 to 826 c/kg cwt in Q4, while retail lamb prices rose from 18.61 $/kg rwt to 19.06 $/kg rwt. Unlike cattle, the producer share for lamb remained stable at 61.9%, indicating that producers were able to maintain a strong share of the retail value.

Index movements further illustrate these shifts. The saleyard cattle index fell from 395 to 383, highlighting weaker market conditions, whereas the saleyard lamb index increased from 436 to 446, suggesting stronger demand or a tightening supply. On the retail side, both beef and lamb indices edged higher, with beef increasing from 262 to 264 and lamb rising from 291 to 298.

Overall, these trends indicate challenging conditions for cattle producers, as rising retail prices have not translated into higher saleyard returns. In contrast, lamb producers have benefited from increased prices while maintaining a steady share of retail value, reinforcing the sector’s resilience.

This analysis is produced in conjunction with Beef Central and Sheep Central. At Episode 3 we are always happy to explore ways of working together with complimentary organisations. If you want to know more about what we do, or want to have a chat about how we can assist your business feel free to reach out to us on email at info@episode3.net or via the contact us page.