Key Points

- OTH goat prices are recovering, aligning strongly with rampant US exports goats were the first market to fall in H2 2022 and generally lead the market on price change.

- Live export demand remains solid at present, tighter supply in the northern market (Darwin) has seen boats shifted to the east coast port of Townsville to fill supply for Indonesian orders.

- Feeder margins on 100-day export steer are favourable at present, as feedlots look to pull levers other than weights like feed efficiency and Days on feed to further extend margins.

Goats & a lead indicator

- In 2024 based on NLRS, goat slaughter has already reached its highest level on record, with 2 months remaining in the year.

- OTH goat prices 12-16kg based on October 2024 monthly values, are in the 57th percentile since OTH records began in 2003 – although are 245c/kg cwt or 47% below the 10-year average.

- OTH Goat prices have recovered by 59% or 122c/kg cwt since October 2023.

- Australia exports on average 55-60% of its goatmeat each year to the US. In 2023, YTD goat exports to the US east coast have lifted 122% YTD YoY, replacing the hole a lack of Chinese demand has left for goat product in 2024.

- Why all of this is relevant and important, is because goat prices softening in 2022 from their record highs of $10/kg cwt were actually a lead indicator for the rest of the market to follow.

- Goat exports to the US and subsequently overall goat prices have recovered strongly as the US ethnic consumer switches out of beef back into goatmeat as cost of living pressures bite and Australian goat is a cheaper protein alternative to US domestic beef.

- As the true effects of US domestic beef production declining emerge, the signals are there for a continued recovery in goat prices despite slaughter and production volumes performing very well.

- Watch the goat market moving forwards, higher US demand at the same time as supply reduces (over time) will support market prices. This also applies to the mutton market when consumers return to Australian mutton over US domestic beef.

Supply

- Plentiful availability of Angus in northern NSW continue to flow, pressuring the seasonal spread of Angus over flatback cattle – same applies for F1’s.

- Slaughter continues to strengthen, with processors (based on NLRS) pushing their best weekly kill since early January 2020 at 145,000 head.

- Seemingly, plants after some tumultuous weeks with disruptions are finding their groove with plenty of cattle in front.

- It wouldn’t surprise me if the overall national number finds another couple of notches higher before the end of 2024.

- Watch SA kill numbers when ABS reports in 3 weeks time, NLRS kill figures look significantly lower than ABS actuals, this should assist Q3 kill figures to further lift.

- NT Live exporters are finding themselves a little shorter on supply than they’d like with boats moving across to Townsville to fill demand from Indonesia for public holidays in 2025 post feeding.

Demand

- Feedlot’s are well placed at present with current bought cattle supporting a profitable trade, even with inflated and forward values providing a buffer, margins look good.

- The disparity or premium for heavier feeder cattle has certainly eroded compared to winter – plenty of conversations this week discussing the lack of demand from feeders for heavy steers due to the higher supply and how the numbers stack up.

- Live export demand is solid at present, cattle supply out of the NT floodplains hasn’t yet kicked into gear and for the Darwin feeder price this meant its prices have lifted in the vicinity of 20c/kg lwt in the past 3-4 weeks.

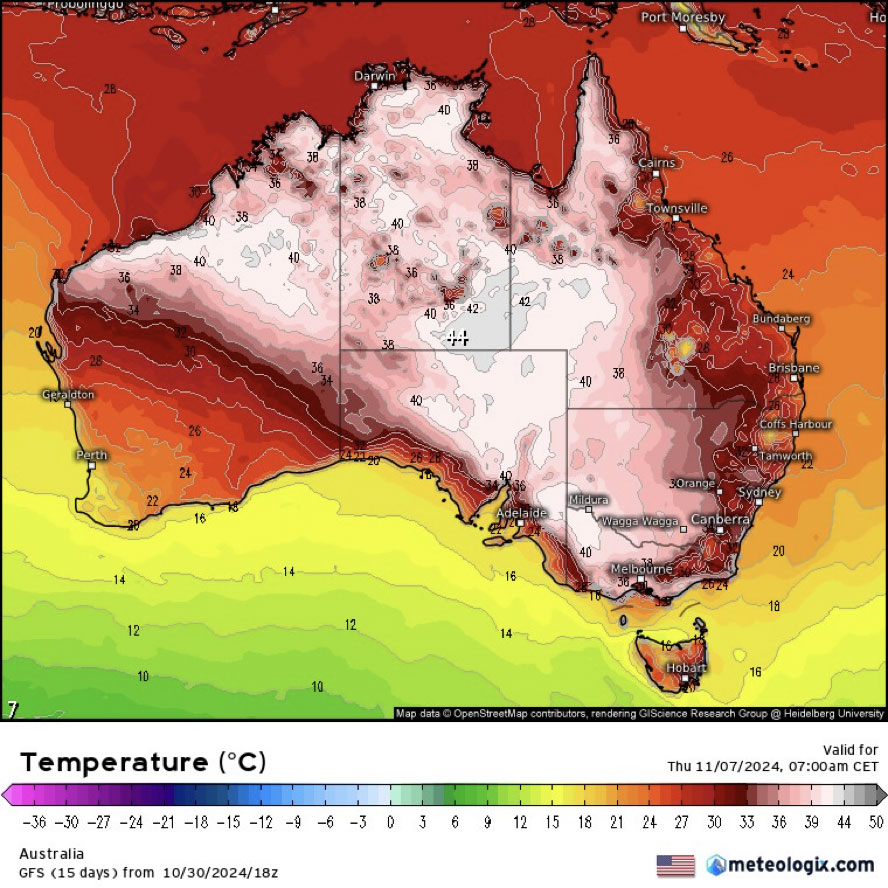

- Will the hotter, drier weather due in the next 10 days take the sting out of restocker demand? I drove Sydney – Orange – Wellington – Coolah – Nundle – Sydney last week and there’s a lot of grass available although it’s starting to hay off now.

Price

- Restocker heifers back in vogue all of a sudden… Nationally heifers up 13c/kg lwt this week.

- Premium for heavier feeder cattle falling at a rate of knots, plentiful supply of heavier drafts is shifting this spread back to what’s considered “normal”, which is a discount.

- Market conditions, cattle supply and ration cost dictate where this premium sits, the spread is changing now as feedlots are extracting margin elsewhere with the levers they can pull, like DOF and feed efficiency.

- If feedlots are comfortably covered and operating hand to mouth, we need to see a material shift in A) weather pattern or B) supply to adjust current rates – neither of which look likely with a generally clear 10 days in front of us, this also applies for processors.

Weather

- Some isolated thunderstorms throughout QLD were the only real weather event on the mainland this week – which did disrupt some supply. The western half of Tassie continues to enjoy solid rainfall events.

- A hot week is in order for most of the country over the next week, with little in the way of rainfall, 7 day GFS temperature forecast below.

- Its these kinds of successive weeks of hot weather which can have a negative impact on the market through changing sentiment and wariness from producers. Keep an eye on this as we enter the last 8 weeks of 2024.

- Fire danger is a risk with the kind of heat and winds forecast. The next major cycle is due week 2 November onwards where a trough from the west impacting southern Australia and another the Gulf is suggesting heavier thunderstorms for eastern QLD.

Ripley Atkinson | Australian Livestock & Commodities Manager

M: +61 427 417 803

www.stonex.com | ripley.atkinson@stonex.com

StoneX Financial Pty Ltd (ACN 141 774 727 | ABN 50 141 774 727)

Suite 28.01 | 264 George Street | Sydney | NSW | Australia

NASDAQ: SNEX

StoneX Disclaimer

The StoneX Group Inc. group of companies provides financial services worldwide through its subsidiaries, including physical commodities, securities, exchange-traded and over-the-counter derivatives, risk management, global payments and foreign exchange products in accordance with applicable law in the jurisdictions where services are provided. References to over-the-counter (“OTC”) products or swaps are made on behalf of StoneX Markets LLC (“SXM”), a member of the National Futures Association (“NFA”) and provisionally registered with the U.S. Commodity Futures Trading Commission (“CFTC”) as a swap dealer. SXM’s products are designed only for individuals or firms who qualify under CFTC rules as an ‘Eligible Contract Participant’ (“ECP”) and who have been accepted as customers of SXM. StoneX Financial Inc. (“SFI”) is a member of FINRA/NFA/SIPC and registered with the MSRB. SFI is registered with the U.S. Securities and Exchange Commission (“SEC”) as a Broker-Dealer and with the CFTC as a Futures Commission Merchant and Commodity Trading Adviser. References to securities trading are made on behalf of the BD Division of SFI and are intended only for an audience of institutional clients as defined by FINRA Rule 4512(c). References to exchange-traded futures and options are made on behalf of the FCM Division of SFI. StoneX is a trading name of StoneX Financial Ltd (“SFL”). SFL is registered in England and Wales, Company No. 5616586. SFL is authorized and regulated by the Financial Conduct Authority [FRN 446717] to provide to professional and eligible customers including: arrangement, execution and, where required, clearing derivative transactions in exchange traded futures and options. SFL is also authorised to engage in the arrangement and execution of transactions in certain OTC products, certain securities trading, precious metals trading and payment services to eligible customers. SFL is authorised & regulated by the Financial Conduct Authority under the Payment Services Regulations 2017 for the provision of payment services. SFL is a category 1 ring-dealing member of the London Metal Exchange. In addition SFL also engages in other physically delivered commodities business and other general business activities which are unregulated and not required to be authorised by the Financial Conduct Authority. StoneX Group Inc. acts as agent for SFL in New York with respect to its payments services business. StoneX APAC Pte. Ltd. acts as agent for SFL in Singapore with respect to its payments services business.

StoneX Financial Pty Ltd (ACN 141 774 727) holds an Australian Financial Service License (AFSL: 345646) for Dealing in Securities, Exchange-Traded Derivatives Contracts, OTC Derivatives Contracts and Foreign Exchange Contracts, and is regulated by the Australian Securities and Investments Commission.

‘StoneX’ is the trade name used by StoneX Group Inc. and all its associated entities and subsidiaries.

Trading swaps and over-the-counter derivatives, exchange-traded derivatives and options and securities involves substantial risk and is not suitable for all investors. Past performance of any futures or option is not indicative of future success. Indicators are not a trading system and are not published as a specific trade recommendation. The information herein is not a recommendation to trade nor investment research or an offer to buy or sell any derivative or security. It does not take into account your particular investment objectives, financial situation or needs and does not create a binding obligation on any of the StoneX group of companies to enter into any transaction with you. You are advised to perform an independent investigation of any transaction to determine whether any transaction is suitable for you. No part of this material may be copied, photocopied or duplicated in any form by any means or redistributed without the prior written consent of StoneX Group Inc.