Quarterly Food Inflation Update – September 2024

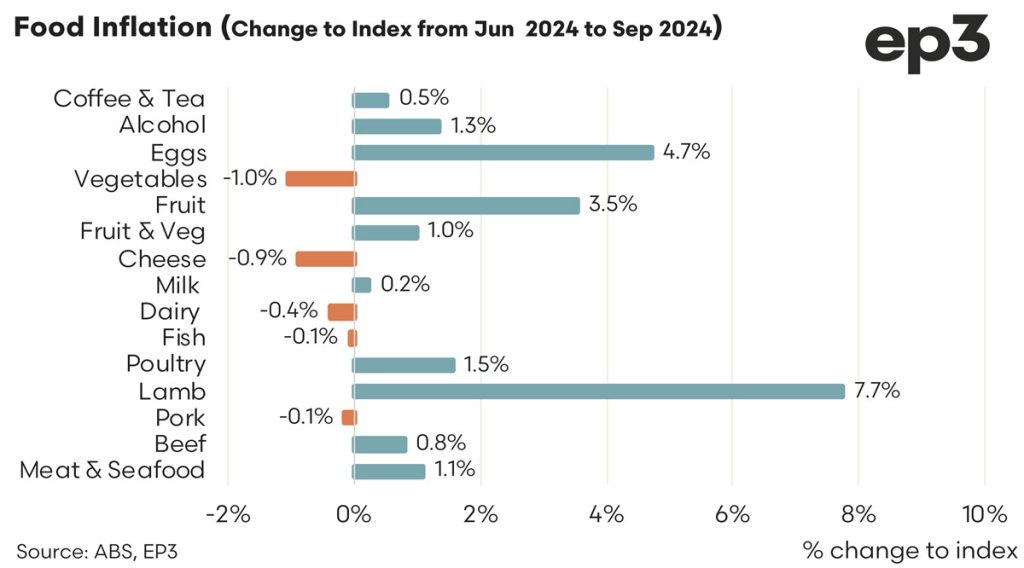

During the September quarter the Australian Bureau of Statistics (ABS) consumer price data showed a big lift in the retail price of lamb with this category showing a 7.7% increase from the June quarter figures. Eggs and Fruit also saw a noticeable lift in prices of 4.7% and 3.5%, respectively. Meanwhile leading the deflationary trend with reduced pricing at the retail level over the quarter was vegetables, down by 1.0%, and cheese, which saw prices 0.9% lower.

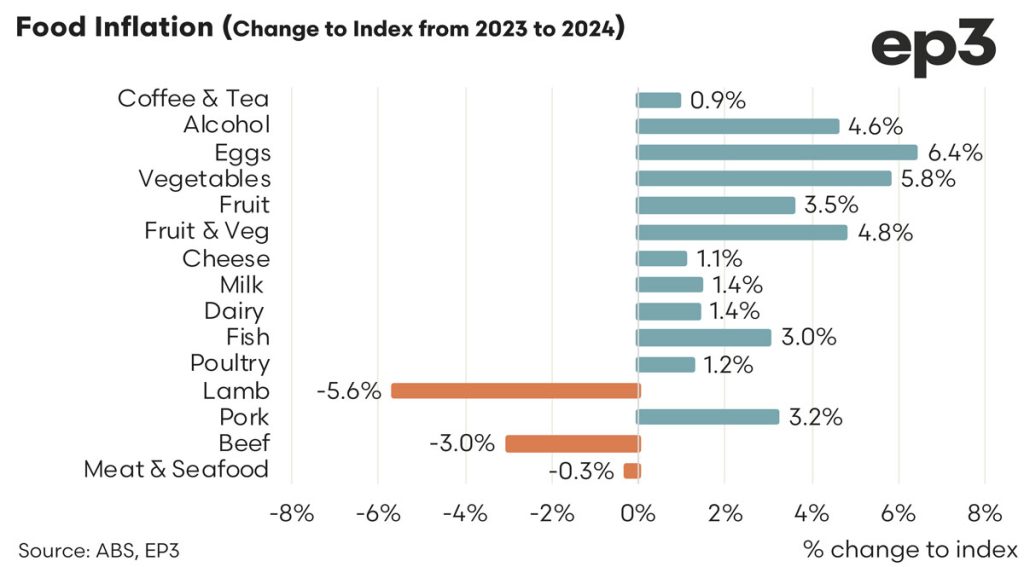

Analysis of the indicators on an annual basis painted a different picture with red meat the only categories still showing significant deflationary trends. Compared to the 2023 season the current price levels for lamb in 2024 are still 5.6% softer than last year, even despite the strong quarterly boost seen over the September quarter 2024. Meanwhile, the beef category has prices 3.0% under the levels seen last year. Higher pork, poultry and seafood pricing versus lower red meat pricing annually has the combined Meat & Seafood category somewhat offsetting gains and losses across meat types and is coming in just 0.3% softer than what we saw in 2023.

Ongoing supply concerns still have eggs leading the inflationary trends across the food items on the annual calculations with prices up by 6.4% in 2024 compared to the 2023 season.